TCFD

Task Force on Climate-Related Financial Disclosures

Kirby has committed to its stakeholders to enhancing its ESG disclosures by integrating elements of TCFD into its sustainability reporting. Established in 2015 by the Financial Stability Board (FSB), the Task Force on Climate-related Disclosures (TCFD) was asked to develop recommendations for more effective, voluntary climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions.

The task force developed four widely adoptable recommendations on climate-related financial disclosures that are applicable to organizations across different sectors and jurisdictions. The recommendations represent core elements of how organizations operate: governance, strategy, risk management, and metrics and targets. Each of the TCFD thematic elements is reflected in the structure of our disclosures on the following pages. In this initial TCFD report, Kirby has primarily focused on scenarios in the marine transportation business which represents 98% of the company’s greenhouse gas emissions. We anticipate further enhancements, refinements, and disclosures in the future as the experience and practice of TCFD reporting becomes more common amongst global companies.

Governance

The organization’s governance around

climate-related risks and opportunities.

Strategy

The actual and potential impacts of

climate-related risks and opportunities

on the organization’s businesses,

strategy, and financial planning.

Risk Management

The processes used by the organization

to identify, asses, and manage

climate-related risks.

Metrics and Targets

The metrics and targets used to assess

and manage relevant climate-related

risks and opportunites.

Petrochemicals Are a Key Driver of Kirby’s Growth

“The chemical sector is the largest industrial consumer of both oil and gas.”

“Petrochemicals—components derived from oil and gas that are used in all sorts of daily products such as plastics, fertilizers, packaging, clothing, digital devices, medical equipment, detergents, and tires—are becoming the largest drivers of global oil demand, in front of cars, planes, and trucks.”

Kirby’s Marine Transportation Group moves thousands of cargo tons of petrochemical, refined, and agricultural products annually. According to the National Waterways Foundation, moving products via the waterway is the safest and most environmentally friendly mode of transportation. As noted in the graph below, demand for these products has increased over the years and according to the IEA is expected to do so moving forward. Therefore, the company is met with a dual challenge. Global demand for petrochemicals is forecasted to continue increasing, but the manufacturing and delivery of these products is expected without additional carbon emissions. Growth for business will continue to increase, thus the rise in potential CO2 emissions from fuel usage to move said products. Under the two-degree Celsius framework as recognized by the Paris Agreement within the United Nations Framework Convention on Climate Change, stakeholders have requested that companies do their part in reducing carbon dioxide emissions. Kirby is taking action to contribute to the emissions reduction effort and is developing its corporate short- and long-term strategy. We are continuously monitoring forecasts through the Board’s oversight and a network of sustainability teams along with an ESG Executive Committee, and Kirby is well positioned to implement its resilience strategy and succeed in reducing emissions.

Total petrochemical consumption outlook

Despite the decline in demand due to the COVID-19 pandemic, oil demand for petrochemical feedstock is expected to grow by 3 mb/d through to 2030, and by a further 1.5 mb/d to just over 17 mb/d in 2030.

Black Oil

- Crude Oil

- Asphalt

- Fuel Oil

- Carbon Black

- Vacuum Gas Oil

- Vacuum Tower

- Bottoms

- Bunker Fuel

- Residual Fuel

- Etc.

Pressurized

- LPG

- Propane

- Butadiene

- Isobutane

- Propylene

- Ethylene

- Butane

- Raffinate

- Natural Gasoline

- Etc.

Petrochemicals

- Methanol

- Ethanol

- Reformate

- Naphtha

- Ethylene

- Propylene Oxide

- Menoethylene Glycol

- Vinyl Acetate Monomer

- Benzene

- Ethyl Benzene

- Toluene

- Xylene

- Paraxylene

- Styrene

- Caustic Soda

- Acrylonitrile

- Etc.

Refined Products

- Kerosene / Jet Fuel

- No. 2 Oil

– Diesel Oil

– Heating Oil - Lube Oil

- Etc.

Agriculture

- Ammonia

- Ammonium Thiosulfate

- Urea Ammonium Nitrate (UAN)

- Etc.

Kirby Contributes to a Better Quality of Life Every Day

Kirby’s products and services are vital to the development of common end-products illustrated in this slide and are used by people daily. Our involvement stretches from our marine transportation business which safely and efficiently moves millions of cargo tons of petrochemicals, refined products, and agricultural liquids annually, to the environmentally friendly oilfield equipment manufactured by Kirby Distribution and Services. We are proud to play a critical role in the supply chain of countless products which create a better quality of life for people around the world.

Governance

A. Describe the board’s oversight of climate-related risks and opportunities.

Kirby Corporation’s Board of Directors oversees the Company’s environmental, social, and governance (ESG) initiatives and disclosures. The Board is committed to elevating Kirby’s leadership profile and reputation among our investors, government policymakers, stakeholders, and others on ESG issues and practices and believes the Company has a unique opportunity to be an industry leader on these important issues.

The Board also engaged in strategic discussions regarding incident/emergency response and recovery (i.e. hurricanes), capital allocation, workplace and vessel safety, energy transition, and various alternative future business scenarios.

B. Describe management’s role in assessing and managing climate-related risks and opportunities.

At the management level, climate-related risks and assessing opportunities ultimately reside with the Chief Executive Officer, who chairs the ESG Executive Committee. The Committee includes the segment presidents, Executive Vice President and Chief Financial Officer, Chief Human Resources Officer, Vice President and General Counsel, and Vice President of Investor Relations. Reporting to this Committee is a cross-functional team designed to advise executive leadership and the Board on managing climate and sustainability-related risks and assessing future business opportunities.

Strategy: Overview

Transition risks: Risks related to the transition to a lower-carbon economy including policy and legal risk; technological risk; market risk (for example, consumer preferences); and reputational risk. Transition risks include policy constraints on emissions, imposition of carbon tax, water restrictions, land use restrictions or incentives, and market demand and supply shifts.

Physical risks: Risks associated with physical impacts from climate change, including the two-degree Celsius change, may impact company assets, personnel, and operating companies. These impacts may include acute physical damage from variations in weather patterns (such as severe storms, floods, and drought) and chronic impacts, such as sea-level rise and desertification. Physical risks include the disruption of operations or destruction of property.

In the following sections, Kirby has identified climate-related resiliency themes, risks, and opportunities with potential impact to our business over short (1–3 years), medium (3–5 years), and long-term (5+ years) time horizons and the Company’s approach to each.

Kirby’s resiliency themes of risk assessment, strategy, engagement, and operational efficiency helped guide our team to better understand our roles and responses to said risks.

Strategy: Transition Risks

RISK:

Increased climate-change-related

regulations and disclosures

[Long Term]

Potential Financial Impact

- Capital investments into new technologies to improve data capture and facilitate increased disclosure

- Capital investments to retrofit existing equipment

- Increased costs for enhanced emissions reporting and oversight

- Additional administrative, compliance, and legal costs

- Proactive implementation of monitoring, data aggregation, and calculations

- Reporting in accordance with SASB, TCFD, and other reporting frameworks

- Increase monitoring of carbon emissions associated with fuel consumption associated with marine operations to identify and assess operational or technological improvements

RISK:

Changes to oil and gas exploration regulations

[Short Term]

Potential Financial Impact

- Distribution & Services oil and gas businesses could be impacted financially with loss of business and revenue

- Impact to market segments as the need to move certain petroleum products could decline

- Low-cost feedstock advantages for U.S. petrochemical companies could diminish, reducing production and likely limiting new petrochemical plant construction

- Monitor legislation and potential regulatory/administrative proposals

- Research and monitor new trends in the industry

RISK AND OPPORTUNITY:

Transition to low-emissions technology in the marine fleet

[Long Term]

- Investment in the development of new technologies, assets, and vessels

- Retrofit equipment, modify mariner training, and adopt new practices and procedures including operating standards for new equipment

- Potential increase or decrease in operating, engineering, and asset costs

- Potential impact to valuation of certain existing vessels

- Opportunity to be an industry leader in the development and adoption of low-emissions marine equipment

- Long-term strategy of investing in efficient boat fleet, including integrating high-tier standard marine engines and vessel hull design

- Early partnership with original equipment manufacturers (OEMs) regarding designs for low-emission marine engines to achieve future emission standards

- Proactive engagement with customers to understand their future carbon emissions targets and develop complementary initiatives

Distribution & Services customer equipment requirements transition from diesel power to alternative fuel sources such as hydrogen or electric

[Short Term]

- Development of new distribution and dealer relationships with OEMs

- Capital investment in new technologies and R&D

- Opportunity to be an industry leader in the distribution of low-emissions alternative power sources for vehicles, trucks, oilfield equipment, and power generation

- Adopt new practices and modify technician training including operating standards for new equipment

- Executive management plus Board oversight and assessment to monitor emerging innovative technologies in the marketplace

- Investment in new technologies

- Engage with OEMs to lead the transition and develop new advanced technologies

- Proactive engagement with customers to understand their future carbon emissions strategies

- Hydrogen infrastructure is extensive along the Gulf Coast; utilize this to develop knowledge about supply chain opportunities

RISK AND OPPORTUNITY:

[Medium Term]

- Unexpected changes in commodity prices (i.e., fuel costs)

- Potential impact on valuation of certain existing vessels

- Opportunity to develop an industry-leading position in the development and adoption of low-emissions marine equipment

- Executive management plus Board oversight and assessment to follow market trends and stakeholder concerns

- Monitoring and disclosure of the Company’s carbon emissions with long-term targets to reduce impact on the environment

- Adopt long-term strategy to develop new efficient, low carbon emission vessels

- Early partnership with OEMs to develop low-emission marine engines

- Proactive engagement with customers to understand their future carbon emissions targets

[Medium Term]

- Demand for low noise, electric, or dual fuel fracking equipment could offset some of the demand for conventional fracking equipment that may be reduced due to negative perception of fracking industry

- New revenue streams for manufacturing of eco-friendly pressure pumping equipment

- Proactive engagement with customers to understand their future carbon emissions strategies

- Investment in new technologies

- Develop and construct new eco-friendly technologies and equipment to support customers transitioning away from conventional fracking equipment

RISK:

Cargo spills or incidents that occur as a result of a climate-related event (i.e., hurricane, high water) result in negative stakeholder perception

[Short & Long Term]

- Potential reduced revenue from negative customer impacts of the incident

- Increased litigation exposure, mitigation, and clean-up costs

- Higher insurance rates

- Effective U.S. Coast Guard training programs for all mariners

- Safety culture committed to Zero Harm to the Environment, Equipment, and People

- Train well-prepared incident response teams and perform emergency drills with customers, stakeholders, and government authorities

- Spill contingency plans

- Approved procedures

- Vetted equipment

- Maintenance program and oversight

[Medium Term]

- Increased revenue opportunities from customers seeking vendors with leading ESG platforms

- Increased development costs and investments in new technologies

- Cost to retrofit existing marine equipment, train mariners, and adopt new practices and procedures

- Executive management plus Board oversight and assessment to follow trends in the marketplace

- Early partnership with original equipment manufacturers (OEMs) regarding designs for low emission marine engines to achieve future low-emission standards

- Proactive engagement with customers to understand their future carbon emissions targets

Strategy: Physical Risks

More frequent and severe weather events (i.e., hurricanes) leading to increased delays, business interruption, and damages (including marine vessels and facilities)

[Long Term]

Potential Financial Impact

- Loss of revenues resulting from extensive delays due to severe weather events and lower barge utilization

- Increased operating costs

- Self-insured losses for damage to equipment and facilities

- Increased litigation exposure and mitigation/recovery expenses in the event of casualties or spills

- Executive oversight of hurricane preparedness

- Robust hurricane preparedness and emergency management plan

- Proactive coordination and effective communication with the industry and government stakeholders such as the U.S. Coast Guard, Gulf Intracoastal Canal Association, etc.

- Contingency plan identifies safe berths for weather events to protect marine assets

[Long Term]

- Reduced revenue as a result of increased delay days

- Reduced revenue as a result of tow size restrictions

- Increased operating costs resulting from additional boat/horsepower requirements, reduced efficiencies, and higher maintenance

- Increased fuel consumption per ton mile

- Increased costs to mitigate and potential legal expense associated with navigation incidents

- Increased administrative costs to advocate for waterway infrastructure repairs and maintenance

- Effective leadership, participation, and involvement in forecasting, preparing for, and managing high water

- Coordination with industry peers to establish additional horsepower support

- Proactive engagement associations that can advocate waterway infrastructure repairs and maintenance

- Effective communication strategy

- Additional safety preparedness policies and procedures to manage through high water situations

- Effective training programs for mariners to safely navigate high water conditions

Risk Management

Kirby is already experiencing some of the consequences of growing climate-related risks. While many companies are forecasting what could happen in the future, Kirby is exposed to certain climate-related risks in the Company’s marine transportation business given its exposure to hurricanes and high water. In accessing TCFD disclosure and climate-related risks, the impact of weather volatility is a risk that has been identified as evidenced by a National Oceanic and Atmospheric Administration report on Global Warming and Hurricanes.

The Board has the overall responsibility for risk oversight, with a focus on the most significant risks facing the company, including climate change. The Board implements its risk oversight function both as a whole and through delegation to the Committees. Each of the Board Committees is responsible for oversight of risk management practices for categories of risks relevant to its functions, with the Governance Committee being responsible for risks and opportunities related to ESG and the Audit Committee being responsible for the oversight of the Company’s comprehensive risk management plan.

As part of our enterprise risk management process, Kirby is performing a scenario analysis of risks and opportunities associated with changing weather patterns that could have significant impact on our marine transportation operations. Scenario planning is not intended to predict the future, but to highlight potential climate change risks and better prepare the Company for possible future business interruptions and decisions.

The following slides are examples of Kirby’s scenario planning for hurricanes and seasonal high river level conditions, which are growing climate-related risks to the Company’s marine transportation business. In these scenarios, the Company has highlighted why these events are important, the potential financial and operational impacts, and the strategy, processes, and procedures management uses to mitigate the risks.

Hurricanes and tropical storms are an acute physical risk. Climate change could result in hurricanes becoming more frequent and severe, which could impact the waterways, equipment, and potentially create a loss of business opportunities. In order for Kirby to thrive in this type of business, the Company must stay true to its core values of No Harm to People, Equipment, and the Environment. Under these core values and with governance, risk, strategy, and management, the Company positions itself to be resilient to these acute physical risks going forward as the nation’s largest tank barge operator.

Extreme precipitation, wind, and storm surges result in significant disruption and delays to barge movements, customer facilities, waterway infrastructure, and other stakeholders in the path of the storm

Hurricanes are highly unpredictable, with wide weather variability making it impossible to predict the severity of damages

Potential impacts:

Refineries, petrochemical plants, and port terminals may temporarily shut down before and delay opening after a storm, which limits business opportunities for barges to move products and has further ramifications for stakeholders:

- Creates a ripple effect for customers

- End user of products may be impacted by supply shock and higher commodity prices

Damages to equipment and onshore facilities can be costly, which can lead to higher operating expenses

Potential impacts:

More than 10 oil refineries temporarily shut down during Hurricane Harvey

Delay days: 2017 Q3 – 1,965 vs. 2016 Q3 – 929

Property damages

- Nonprofit charitable organization that provides support to Kirby employees, families, and communities affected by natural disasters or qualified family hardship

Strategy and Risk Management

Crisis Readiness – Governance

Kirby management maintains and executes an internal "Hurricane Safety Plan" and works in conjunction externally with the Gulf Intracoastal Canal Association on a "Joint Hurricane Team"

The purpose of the plan is to familiarize Kirby Marine personnel (both vessel and shoreside) with the policies and procedures that apply in the event of a tropical cyclone or storm surge. The procedures will provide a consistent and uniform work practice that will be activated as conditions warrant to help safeguard personnel, equipment, property, and the environment, and foster continual improvement.

Each year the Hurricane Safety Plan is accessed and modified as appropriate based on lessons learned in the previous year

Management roles

Essential personnel group

Monitoring & Assessment

Notify and keep customers informed of actions taking place regarding hurricane safety and preparedness.

Ensure all vessels have hurricane plans, which are reviewed and approved.

Ensure crew and staff are aware of risks; provide adequate supplies should employees remain at office locations.

Strategy and Risk Management

Port Conditions for Hurricanes and Severe Weather

Risk Mitigation and Safety Preparedness

Spill contingency plans

Maintenance program and oversight

2020 Named Storms Impacting Kirby Operations

- Cristobal – June 7

- Hanna – July 25

- Marco – August 24

- Laura – August 27

- Sally – September 16

- Beta – September 22

- Delta – October 9

- Epsilon – October 21

- Zeta – October 28

- Iota – November 17

High water is a chronic risk. If climate-related changes result in storms becoming more severe or frequent, increased precipitation upriver (i.e., St. Louis, Cincinnati) results in a higher likelihood of high-water conditions downriver (i.e., New Orleans).

Acute impact:

Hazardous situations arise:

- Water current velocity increases, which can increase the rate that barges and tugs move

- Eddies can form under river bends and water flows in different directions, which could create potential navigation risks

- High-water conditions could increase risk of navigational incidents

- Mandated waterway closures and daylight-only travel restrictions implemented by the Coast Guard increase delays and may reduce revenue

- Reduced tow size requirements may lead to reduced revenue

- Increased operating costs for additional boats at bridges and docks

- Increased costs to mitigate and litigate potential navigational incidents

Chronic impact:

Results in "choking" barge traffic to less than optimal rates

Results in more trips for less cargo, reducing operating efficiencies and increasing maintenance costs per ton-mile of cargo transported

Strategy & Risk Management

Industry is governed by the Coast Guard’s Waterways Action Plan (WAP) during periods of high water

Trade association

- Waterways Council, Inc. - the only national organization that advocates for a modern, efficient and wellmaintained of inland waterways, including lock and dam infrastructure, and channel maintenance

- Gulf Intracoastal Canal Association - mission is to facilitate commerce through ensuring safe, reliable, and efficient Gulf Coast waterways

- The National Waterways Foundation is a center for research and learning where industry leaders and thinkers can address public policy issues related to America's inland waterways system

- Through studies, education and training programs, grants, forums and similar activities, the Foundation helps the public to understand how to maintain our waterways system, enhance its capabilities and promote its value in the years ahead

Daily High Water Report – Includes all vessels on the river or destined for the Mississippi River System. This report provides information to assist in addressing crewing during high-water events given the potential risks associated with navigating an area affected by high-water.

High Water Conference Calls: The VP of Traffic hosts regular conference calls with members of the commercial and operations teams designed to heighten communication and awareness of high-water conditions and operating restrictions

Weather updates, river forecasts, number of vessels on as well as destined for the river, fleet capacity updates, and comments from the executive staff make up the meeting.

Employ manning and vessel strategies to support safety objectives and reduce navigation incidents

In addition to the trend in low-emission technology, there is a potential for reduced demand for conventional oil and gas pressure pumping services as new alternative energy technologies become viable. However, Kirby is uniquely positioned in that its partnership with OEMs enables it to market its equipment to new markets. This is an emerging opportunity for Kirby, and it is one that Kirby is pursuing as a long-term strategy.

Why is the energy technology transition an opportunity for the distribution and services businesses?

- As described in Kirby’s Form 10-K, greenhouse gas emissions, including carbon emissions or energy use, have increasingly become the subject of a large amount of international, national, regional, state and local attention.

- Investors and customers are encouraging oil and gas companies to invest in emissions reducing alternatives and to consider low emission alternative energy technologies. Thus, there is increased demand for low emission oil and gas pressure pumping equipment through low-emissions technology and electrification.

- KDS is positioned as a leader due to its technology solutions. KDS designs and manufactures equipment that can significantly reduce the emissions from hydraulic fracturing.

- Through its subsidiary, S&S, it was the first to bring electric fracturing equipment to the market that reduces emissions compared to traditional diesel combustion units

- KDS has designed and is further developing natural gas power generation and energy storage systems solutions, which offer expansion opportunities into new commercial and industrial markets while reducing emissions

- Demand for low noise, electric, or dual fuel equipment is anticipated to offset reduced demand for conventional pressure pumping equipment

- Focus on industry leadership in the distribution of low-emissions alternative power sources for vehicles, trucks, oilfield equipment, and power generation

- Diversification through applying its expertise to new markets

Kirby manufactures power generation equipment that is creating opportunities in new commercial and industrial markets

Natural Gas Reciprocating Generators

- High Power Output: 2.5 MW

- High Mobility: 53’ x 8.5’ x 13.5’

- Wide Operating Range: Up to 122ºF operation

- Sound attenuated environmental enclosure

- Scalable operation with multiple generators

- Integrates with existing S&S power distribution products

- 27.5% more fuel efficient than turbines assuming zero grid power supply at net zero consumption

- Reduces CO2e by 32% resulting in the cleanest power platform available for e-frac

- High Power Density: Up to 3 MWh storage capacity

- High Power Output: Up to 3 MW

- High Mobility: 53’ x 8.5’ x 13.5’

- Self Contained: Drive-up and plug-in (no additional rig-up)

- Output Voltage Flexibility: 13,800 volt shown

- Wide Operating Range: Up to 122ºF operation

- Intelligent Operation: Advanced Battery Management System (BMS) and Power Management System (PMS)

- Highly Scalable: Platform Based Design (allows for smaller systems or use of multiple systems to meet different power demands)

- Integrated Turnkey Packages: ESS compliments existing S&S power generation and power distribution products

Strategy & Opportunity Management

Opportunity Readiness – Governance

- Executive management plus Board oversight and assessment to monitor emerging innovative technologies in the marketplace

- Monitoring state and federal policy regarding legislation impacting oil and gas production and policies to increase environmentally friendly technologies or mandates

- Monitor emerging macro level insights to better understand market trends and forecasting

Strategy

- Investment in new technologies and partnerships with OEMs to meet customer demands

- Develop and construct new eco-friendly technologies and equipment to support customers transitioning away from conventional fracking equipment

- Enable customers to achieve their carbon emissions reduction goals and commitments

- Capital investment in new technologies and R&D

- Adopt new practices and modify technician training including operating standards for new equipment

- Development of new distribution and dealer relationships with OEMs

- Industry leadership in the distribution of low-emissions alternative power sources for vehicles, trucks, oilfield equipment, and power generation

- Continue innovation and commercialization of eco-friendly pressure pumping equipment with electric, dual fuel, and low noise products that support our customers needs to reduce emissions and environmental impact.

- New revenue streams from applying natural gas power generation equipment to new markets including back-up power in commercial and industrial applications

- Develop and expand energy storage system solutions that have combined high powered storage and the capability to work in challenging operation conditions with the potential for vast application use

Marine Transportation – GHG Emissions

~99% of Kirby’s emissions are from the marine transportation fleet

Emissions Performance (2015 to 2023)

- Since 2015, total CO2e emissions have declined 16% despite significant growth in the fleet

- Total barrel capacity up 11%

- Result of inland fleet acquisitions offset by offshore fleet retirements

- Diesel consumption declined 5% ‘22Y/’23Y despite increased activity in ton-miles

- Since 2015, average age of inland boats is down ~13 years and offshore boats is down ~18 years

Emissions Reduction Targets:

- Short term target: Overall, Kirby emissions declined 24%per barrel of capacity by 2024, nearing our goal of 25%

- Long term target: 40% reduction of emissions per barrel of capacity by 2040

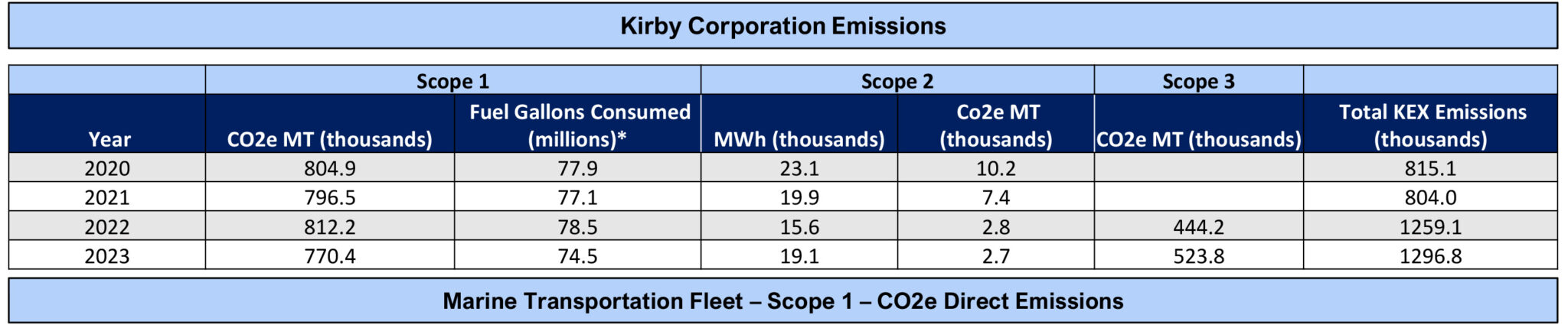

Kirby Corporation – GHG Emissions Summary

Scope 1 Emissions Performance

- ~99% of Kirby Corporation Scope 1 GHG emissions come from marine transportation operations, primarily towboats and tugboats

- Ultra low sulfur diesel fuel consumption and CO2e emissions have declined 16% since 2015 despite significant growth in the number of vessels in the fleet

- Emissions data reporting project completed in 2022 – helps Kirby to better understand it’s emissions footprint on a micro level and assist customers in achieving their emissions reductions goals

Scope 2 Emissions Performance

- While Scope 2 MWh increased year on year, overall CO2eMT declined due to providers utilizing more renewable energy sources for electricity such as wind and solar

- 100% of Scope 2 energy is consumed from the grid

- Signed a 36-month agreement for 100% green e-certified energy in April 2020 for all Kirby marine transportation facilities in Texas

- ECO Solutions Champion issued ~3,000 renewable energy certificates in 2023; 100% renewable representation

- ~20% of Scope 2 energy is renewable